Crude Sinks on Renewed Russia-Ukraine Peace Prospects

Oil Pushing Lower

Crude prices are coming under heavy selling pressure today as easing geopolitical fears weigh on sentiment. The renewed prospect of a Russia Ukraine peace deal is back in focus following news that Zelensky has agreed to take part in negotiations centered around Trump’s peace plan. Trump’s proposed 28-point peace agreement, sketched out between Washington and Moscow, includes land concessions from Ukraine which previously have been cited as a dealbreaker. However, with Zelensky signalling a willingness to negotiate there is hope that the time for a deal is finally approaching after 4 long years of war.

Oversupply Fears

If successful in implementing the peace deal, Russia would be allowed to rejoin the G7, making it the G8, with all sanctions lifted. Consequently, cure traders are eyeing the prospect of Russian oil returning to the wider market. Given the oversupply fears which have been flagged by the EIA and OPEC recently, the timing of such a move could be firmly bearish for cure prices next year as the market recalibrates around the return of Russian supply.

Hawkish Fed Repricing

Alongside geopolitical developments, crude is also being weighed on by a less hawkish Fed outlook. The release of the delayed September NFP data yesterday saw a jump in the headline reading which has create further pushback against December easing expectations. With USD looking poised for furtehr upside near-term, crude prices are at risks of a fresh push lower.

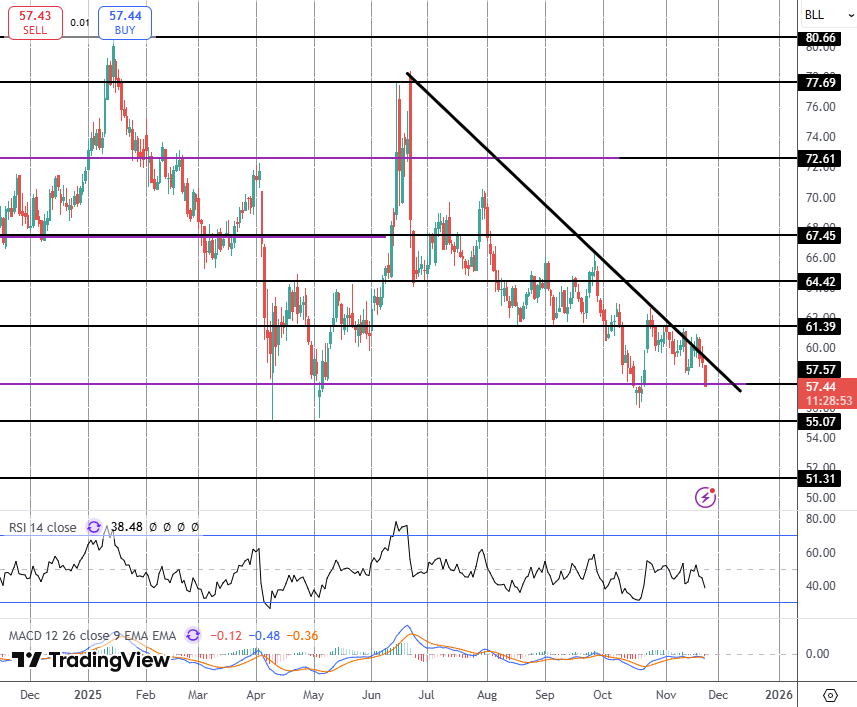

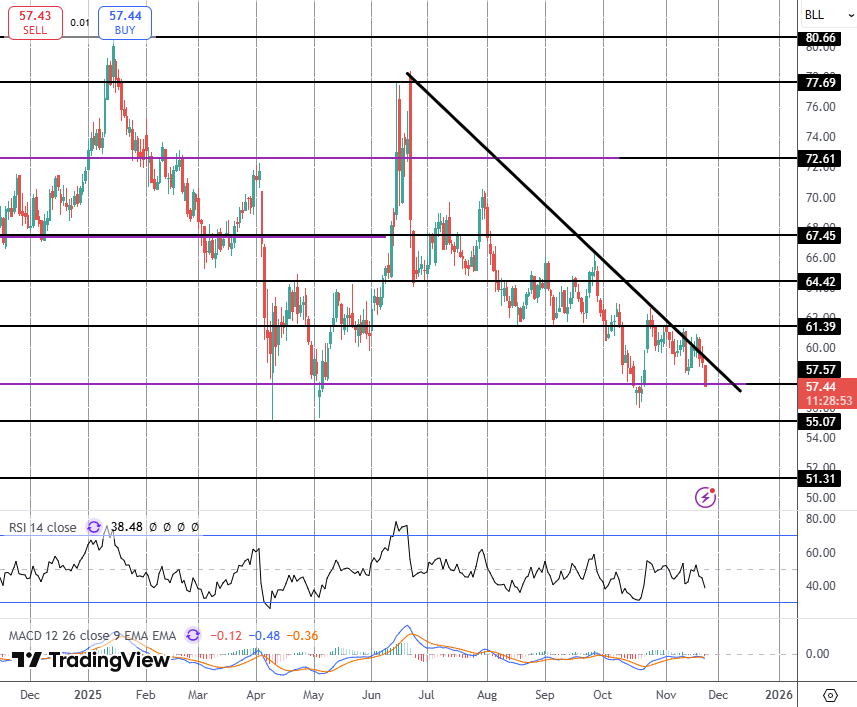

Technical Views

Crude

The failure at 61.39 has seen the market grinding lower in a choppy fashion. However, sellers are starting to gain momentum now with price back under the bear trend line and testing support at the 57.57 level. With momentum studies bearish, risks of a deeper push towards 55.07 are seen.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.