FTSE 100 FINISH LINE 28/1/26

FTSE 100 FINISH LINE 28/1/26

The UK’s leading stock market index, the FTSE 100, suffered losses on Wednesday, weighed down by declines in banking and healthcare stocks. Investors analysed corporate earnings reports while closely monitoring the U.S. Federal Reserve's anticipated policy announcement. By the end of the day, the FTSE 100 closed in negative territory. In contrast, the domestically focused FTSE 250 edged up 0.1%, briefly hitting its highest level since January 2022 earlier in the session.

Natural gas futures surged approximately 40% this month, surpassing 100 GBp/therm. However, the impact on UK inflation forecasts appears limited. The futures curve indicates a more moderate price increase in the longer term, with the Q2 2026 energy price cap for households forecasted to be significantly lower than last year’s elevated levels. Even if January’s price surge persists, the year-on-year drop in wholesale prices is projected to range between 34.5% and 38%. Since wholesale prices constitute roughly 40% of the OFGEM price cap, household energy bills could decline by 14% to 15.5% year-on-year. Given that utilities make up about 3% of the CPI basket, the monthly rise in wholesale gas prices is expected to add just 5 basis points to Q2 CPI. Overall, the recent price increase offsets previous weaker levels, providing a strong tailwind for annual CPI rates this spring.

Stock and sector-specific developments revealed healthcare stocks as a major drag on the FTSE 100, falling 1.9%. Pharmaceutical giants GSK and AstraZeneca dropped 1.9% and 2.3%, respectively. Banking shares also retreated, slipping 1.2% after hitting record highs in the prior session. Investec declined 1.6%, while HSBC Holdings and Close Brothers each fell by more than 1%. Luxury goods companies faced headwinds as well, following a sharp 6.7% slump in shares of French luxury giant LVMH after disappointing Q4 results. This downturn rippled across the sector, with Burberry and Watches of Switzerland declining 2.5% and 2%, respectively.

On a more positive note, precious metal miners rebounded with a 2.1% rise, recovering from Tuesday’s losses as gold prices rallied above $5,300 per ounce. Energy stocks also gained 1%, driven by oil prices reaching their highest levels since late September. Industry leaders Shell and BP each rose around 1%, amid reports of their efforts to secure U.S. licenses for natural gas extraction in Trinidad and Tobago, as well as Venezuela, according to Caribbean energy minister Roodal Moonilal. Elsewhere, Pets at Home shares jumped 5.3% after the pet care retailer reaffirmed its full-year profit forecast, despite reporting a dip in third-quarter revenue attributed to price cuts as part of its retail transformation strategy.

Looking ahead, investors are shifting their attention to upcoming corporate earnings reports for clearer insights into business performance amid ongoing geopolitical tensions and trade uncertainties. Meanwhile, the Federal Reserve’s policy update later in the day remains a key focus, with most market participants expecting the central bank to maintain current interest rates.

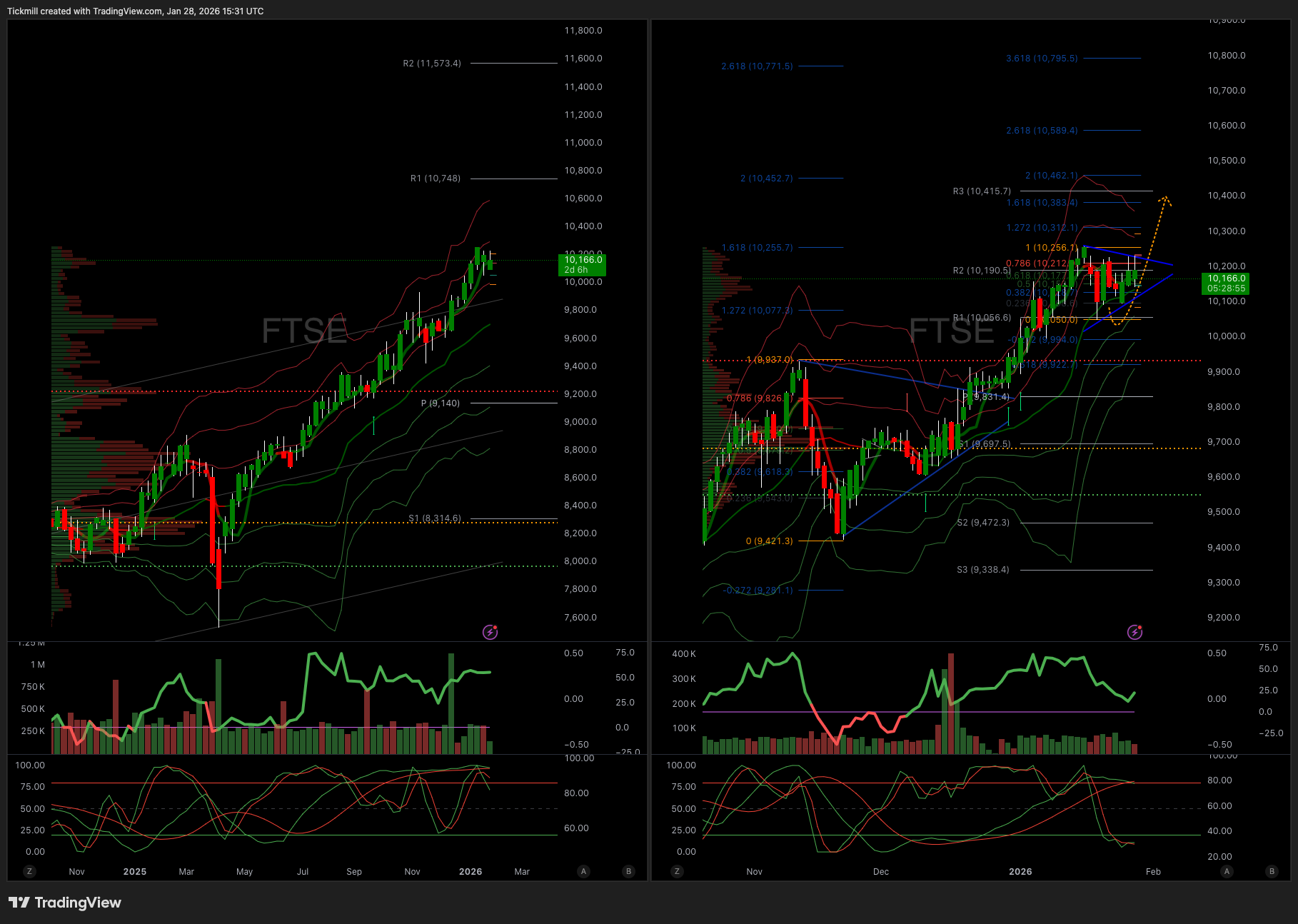

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 10150 Target 10300

Below 10070 Target 9950

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!